Car Loan Approval Malaysia

AmBank Arif Hire Purchase-i. Typically many of the banks we called and spoke with provided margins of between 70 and 90 with the latter subject to the banks decision.

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

Any salary earning individuals self-employed individuals public listed companies private limited companies sole proprietorships and partnerships can apply for a car loan.

. My own car loan in Sept was for a Proton and it was at 313. A car loan requires documentation regarding the car as it is the guarantee that is used as the basis for the loan. Customers are urged to keep their auto loans to no more than 20 percent of their monthly income according to the company.

40000 per month your monthly automobile loan EMI should not be more than Rs. The car loan application process. Alliance Bank Hire Purchase.

For instance Maybank and Public Bank offer 70. An approval of loan amount can be performed within a. Duration of Loan approval Once the verification process is completed the loan officer might call your employer to determine that you are providing accurate information and that you have a sound income.

Used cars can be purchased on a loan too provided theyre not valued too low. Its not impossible to get a loan. Youd obviously know that banks wont lend you money if you dont have an income.

Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia. You may apply for a car loan by visiting any bank of your choice. Be sure to take along all necessary documents which may differ from bank to bank to help speed up the application process.

Once the application and documents are submitted it is up to the bank to decide on the approval of your car loan. Most banks have a net interest margin of between 2 - 3. For example to buy a car with a net worth of RM59993 the officer has a maximum loan eligibility of.

The car loans that are available. 1 Buyer choose model 2 Contact car seller arrange for appoinment 3 Ready all required documents 4 Appointment with consultant at your door step 5 Documents submitted for loan processing 1 2 working days. A car loan in Malaysia is a type of loan that is taken by an individual for the sole reason of buying a car.

To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application. Income and employment history. If you can afford to put down a bigger down payment you stand to save more on interest fees.

Good FICO Scores range between 670 and 739 and a score of more than 739 is considered exceptional. Timing of your application. Individuals must be Malaysian citizens.

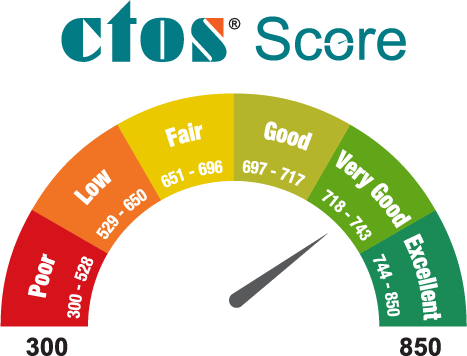

To speed up the approval of your car loan application you can observe these tips before or during your car purchase. - If its RM65000 - an approved loan is RM59900. Established in 1990 CTOS is Malaysias leading Credit Reporting Agency CRA under the ambit of the Credit Reporting Agencies Act 2010.

Banks might offer a lower interest rate if you opt for a lower margin of finance. CIMB auto loans also referred to as hire purchaseprovides expats and foreigners with businesses in Malaysia up to 75 financing. How Do Car Loans In Malaysia Work.

Fast Loan Approval for GoodExcellent Credit. Pretty much the same as any other loan applications car loan approval process will depend on your income employment type current financial commitments debt service ratio and some other lifestyle factors. With the exception of boat or bike loans the loan amount should be rounded to the lower hundred ringgit amount.

Bank Name Car Loan Interest Rates. Relationship with the bank. The eligibility criteria of a car loan are as follows.

Individuals applying for a car loan must be at least 18 years old at the application date. If you earn Rs. Car Loan Approval Process.

Never jeopardize your future just so you get to ride in a cool car. Consider the following scenario. Since BNM has cut the OPR by 125 I had expected the lending rates to be a bit lower than what is shown.

Fast Secure and Straightforward Loan Solutions for Federal Employees. The good thing about taking a loan on a secondhand car is that new PUSPAKOM guidelines require the car to undergo The Hire Purchase Inspection which is a rigorous check to ensure it isnt a cut car and that it is in working order before ownership is passed. Procedure To Appy Loan To Buy A Car Here is the procedure and steps or flow when you buy a new car in Malaysia.

By taking up this loan this individual is tied down to a formal written agreement where the borrower car buyer is indebted to pay the loan amount plus interest to the lender banks financial agents etc over a specified period of time. If its RM55000 an approved loan is RM55000. In Malaysia car loan tenures can take up to 5 7 or even 9 years.

How much car loan can I get on 40000 salary. The Graduate Car Loan. Ad Secure Straightforward Open-ended Loans for Federal Employees.

Shopping for a car loan for your new or used car. Compare Car Loans in Malaysia 2022. Most car loans in Malaysia have a maximum margin of financing of 90 so you should always expect to pay at least 10 upfront to the car dealer.

Fast Easy Approval. Compare and calculate your monthly repayments on Loanstreets car loan calculator and save more than RM100 every month. Maybe local cars 25 and foreign cars 225.

When it comes to getting approved for car loans with decent terms a good credit score is key. If you can afford it consider paying a higher percentage upfront which will in turn lessen your principle loan amount as well as your interest. Get Up to 100K in 24hrs.

Below is a summarised diagram of a typical car loan application process in Malaysia. Purchasing a brand-new car is usually done with car loans or financing services. Savings and assets.

The banks valuation of the car is important since it serves as a collateral in case of loan default. Ad Get Up to 100000 from 349 APR. Then you will be informed in about 3.

What happens after car loan approval. It is common to have your car dealer arrange for the application of a car loan on your behalf.

Car Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

A Guide To Car Loans Interest Rates In Malaysia

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

Comments

Post a Comment